Nailing the omnichannel supply chain

As the COVID pandemic spread and lockdowns followed, consumers embraced eCommerce, but web engagements with ‘local’ businesses also jumped – up 42% in 2019 – and while 17% prefer to shop completely online, 37% of consumers are still looking to shop locally, which makes omnichannel a most prudent strategy in challenging times.

The big jump in local engagements (clicks) recorded by Google at the start of the 1st lockdown cannot be translated into more consumers visiting locations, but it is reflective of shoppers using the internet to gather information about a business, buy something online, use click-and-collect or engage with a business in safer ways.

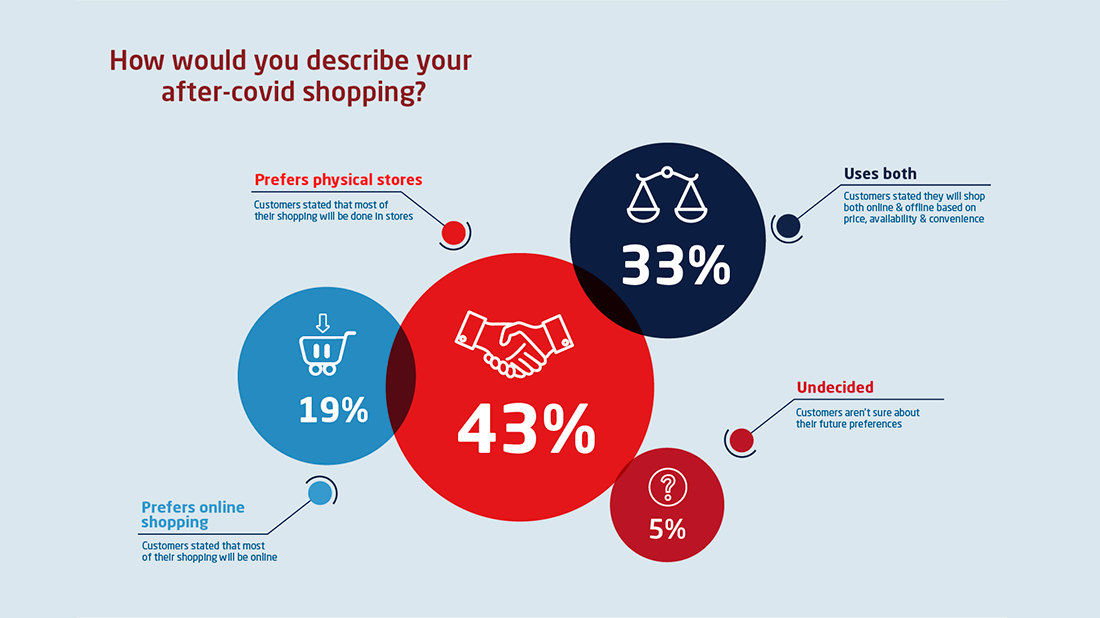

Post-pandemic, there is a big share of consumers who prefer to shop locally (37%) and while almost 20% prefer to shop completely online, over a third would either prefer to check a product out in the store and buy it online or vice-versa by using click-and-collect – and use different channels in a complementary fashion.

Preferred way To shop:

- 43% MOST OF MY SHOPPING WILL BE DONE IN STORES

- 33% I’LL SHOP BOTH ONLINE & OFFLINE BASED ON PRICE, AVAILABILITY & CONVENIENCE

- 19% MOST OF MY SHOPPING WILL BE ONLINE

Source Uberall

The customer journey is increasingly hybrid, as consumers convert online or offline as they see fit and they expect more options to complete their purchase via click-and-collect, click-and-meet, home delivery etc.

McKinsey, the global management consulting firm, places the supply chain at the core of omnichannel strategy, with three key supply chain processes: end-to-end information flow; omnichannel fulfilment; and omnichannel transport.

Information flow

End-to-end supply chain visibility should be seamless among functions, channels, and locations. Cross-channel inventory pools, will give consumers real-time visibility of availability, while orders can be fulfilled efficiently through continuously re-optimised allocations across all channels and locations.

Omnichannel fulfilment

The physical flow of eCommerce products is very different from the flow of products within a retail DC, with eCommerce primarily concerned with individual units, rather than full truckloads or pallets. And buyers expect very short lead times, while cost is often more important than speed in-store replenishment.

Transport

Omnichannel players need partners who can deliver small shipments quickly, reliably, and relatively inexpensively, but they likely also need partners that can manage large volumes of product moving simultaneously to, from and across regions, in complex global supply chains, that require information management and regulatory compliance support.

Noatum Logistics work with retailers and brands, of all sizes, on every continent. Delivering inventory from source to DC, replenishing stores, serving eCommerce customers around the world and sharing critical data through our powerful PowerView platform.

Noatum Logstics’ omnichannel solutions embrace:

- End-to-end supply chain visibility

- Global inventory management

- Multi-modal freight forwarding

- Flexible warehousing

- eCommerce fulfilment

- Courier management

- Store replenishment

- EU distribution

- Cross-border clearance services

- Last-mile delivery